3. Understanding Financial Statement

Understanding Financial Statements

How valuable are the assets of a firm?

How did the firm raise the funds to finance these assets?

How profitable are these assets?

How much uncertainty (or risk) is embedded in these assets?

The Basic Account Statements

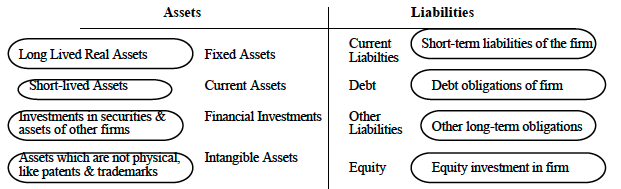

Balance Sheet

- summarizes the assets owned by a firm, the value of these assets and the mix of financing, debt and equity, used to finance these assets at a point in time.

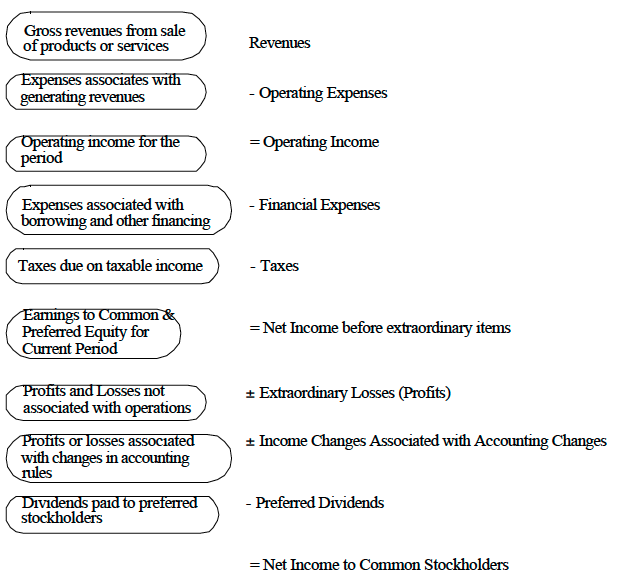

Income Statement

- provides information on the revenues and expenses of the firm, and the resulting income made by the firm, during a period

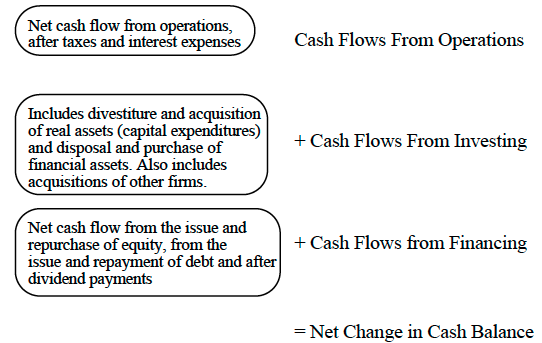

Cash Flow Statements

- specifies the sources and uses of cash of the firm from operating, investing and financing activities, during a period.

Asset Measurement & Valuation

Accounting Principles Underlying Asset Measurement

- historical cost, book value : the original cost of the asset

- An Abiding Belief in Book Value as the Best Estimate of Value

- A Distrust of Market or Estimated Value

- A Preference for under estimating value rather than over estimating it

Measuring Asset Value

- Fixed Assets

- require the valuation of fixed assets at historical cost, adjusted for any estimated gain and loss in value from improvements and the aging, respectively, of these assets.

- Depreciation : reflect the loss of earning power of the asset as it ages

- straight line & accelerated value

- Current assets : most amenable to the use of market value

- Account receivable : money owed by entities to the firm on the sale of products on credit

- bad debts: recognize accounts receivable that are not collectible

- Cash

- fewer and fewer companies actually hold cash in the conventional sense

- While there is no real default risk in either of these investments, interest rate movements can affect their value.

- Inventory

- First-in, First-out : the cost of goods sold is based upon the cost of material bought earliest in the period, while the cost of inventory is based upon the cost of material bought latest in the year.

- inventory being valued close to the current replacement cost

- Last-in, First-out : the cost of goods sold is based upon the cost of material bought latest in the period, while the cost of inventory is based upon the cost of material bought earliest in the year

- finished goods being valued close to the current production cost

- Weighted Average : both inventory and the cost of goods sold are based upon the average cost of all materials bought during the period

- LIFO reserve : specify in a footnote the difference in inventory valuation between FIFO and LIFO (since LIFO reduces tax)

- First-in, First-out : the cost of goods sold is based upon the cost of material bought earliest in the period, while the cost of inventory is based upon the cost of material bought latest in the year.

- Investments (Financial) and Marketable Securities : investments made by firms in the securities or assets of other firms

- Minority, passive investment : less than 20% of the overall ownership of that firm

- For investments that will be held to maturity, the valuation is at historical cost or book value, and interest expense

- For investments that are available for sale, the valuation is at market value, but the unrealized gains or losses are shown as part of the equity in the balance sheet and not in the income statement

- For trading investments, the valuation is at market value and the unrealized gains and losses are shown in the income statement.

- Minority, active investment : represent between 20% and 50% of the overall ownership of that firm,

- Majority, active investment : more than 50% of the overall ownership of that firm

- consolidation : no longer shown as a financial investment but is instead replaced by the assets and liabilities of the firm in which the investment was made

- Minority, passive investment : less than 20% of the overall ownership of that firm

- Intangible Assets

- Patents & Trademarks

- When patents and trademarks are generated from internal sources, such as research, the costs incurred in developing the asset are expensed

- when an intangible asset is acquired from an external party, it is treated as an asset.

- Goodwill

- by-products of acquisitions

- Patents & Trademarks

Measuring Financing Mix

Accounting Principles Underlying Liability & Equity Measurement

Strict categorization : to be recognized as a liability

- It must be expected to lead to a future cash outflow or the loss of a future cash inflow at some specified or determinable date

- The firm cannot avoid the obligation.

- The transaction giving rise to the obligation has happened already.

the value of both liabilities and equity in a firm are better estimated using historical costs with accounting adjustments

Measuring the Value of Liablities & Equities

Current Liabilities

- Accounts Payable : credit received from suppliers and other vendor, book & market value should be similar

- Short term borrowing : short term loans (due in less than a year) taken to finance the operations or current asset needs of the business

- Short term portion of long term borrowing : portion of the long term debt or bonds that is coming due in the next year

- Other short term liabilities : catch-all component for any other short term liabilities ex) wage, tax

Long Term Debt

- long-term loan from a bank or other financial institution : principal (face value) due on the borrowing

- long-term bond issued to financial markets : recorded at the issue price, but the premium or discount to the face value is amortized over the life of the bond

Other Long Term Liabilities

Leases

Operating lease : the lessor (or owner) transfers only the right to use the property to the lessee ⇒ treated as opearting expense & does not affect the balance sheet

Capital lease : risks of ownership and enjoys some of the benefits ⇒ recognized both as an asset and as a liability, recognize expenses sooner than equivalent operating leases

(a) The lease life exceeds 75% of the life of the asset.

(b) There is a transfer of ownership to the lessee at the end of the lease term.

(c) There is an option to purchase the asset at a "bargain price" at the end of the lease term.

(d) The present value of the lease payments, discounted at an appropriate discount rate, exceeds 90% of the fair market value of the asset.

Employee Benefits

- Pension Plans : 'defined contribution' (wherein a fixed contribution is made to the plan each year by the employer, without any promises as to the benefits which will be delivered in the plan) or a 'defined benefit' (wherein the employer promises to pay a certain benefit to the employee)

- Health Care Benefits : by making a fixed contribution to a health care plan, without promising specific benefits (analogous to a defined contribution plan), or by promising specific health benefits and setting aside the funds to provide these benefits (analogous to a defined benefit plan)

Deferred Taxes

- the firm's earnings in future periods will be greater as the firm is given credit for the deferred tax

Preferred Stock

- preferred stock is viewed in accounting as a hybrid security, sharing some characteristics with equity and some with debt

Equity

- the original proceeds received by the firm, augmented by any earnings made since, reduced by any dividends paid out during the period

Measuring Earnings & Profitability

- How profitable is a firm? What did it earn on the assets that it invested in?

Accounting Principles Underlying Measurement of Earnings and Profitabilit

- accrual accounting : the revenue from selling a good or service is recognized in the period in which the good is sold or the service is performed (in whole or substantially). A corresponding effort is made on the expense side to match7 expenses to revenues.

- cash accounting : revenues are recognized when payment is received and expenses are recorded when they are paid

- operating expense : provide benefits only for the current period

- financing expense : arising from the non-equity financing used to raise capital for the business

- capital expense : expenses that are expected to generate benefits over multiple periods

Measuring Accounting Earnings & Profitability

GAAP require the recognition of revenues when the service for which the firm is getting paid has been performed in full or substantially and for which it has received in return either cash or a receivable that is both observable and measurable. Expenses linked directly to the production of revenues (like labor and materials) are recognized in the same period in which revenues are recognized.

operating expenses should reflect only those expenses that create revenues in the

current period

- depreciation and amortization : computed on the original historical cost often bears little resemblance to the actual economical depreciation

- research and development expenses

- important that we know how much of these earnings come from the ongoing operations of the firm, and how much can be attributed to unusual or extraordinary events : Unusual or Infrequent items, Extraordinary items, Losses associated with discontinued operations, Gains or losses associated with accounting charges

Measures of Profitability

- One examines the profitability relative to the capital employed to get a rate of return on investment. This can be done either from the viewpoint of just the equity investors, or by looking at the entire firm. Another examines profitability relative to sales, by estimating a profit margin.

1. Return on Asset & Return on Capital

- ROA : operating efficiency in generating profits from its assets, prior to the effects of financing

\[ ROA = \frac{EBIT(1-tax\ rate)}{total\ assets} = \frac{Net\ income+Interest\ expense(1-tax\ rate)}{total\ assets}\\pre-tax\ ROA = \frac{EBIT}{total\ assets}\]

pre-tax : useful if the firm or division is being evaluated for purchase by an acquirer with a different tax rate or structure

ROC : When a substantial portion of the liabilities is either current (such as accounts payable) or non-interest bearing

\[After-tax\ ROC = \frac{EBIT(1-t)}{BV\ of\ Debt+BV\ of\ Equity}=\frac{EBIT(1-t)}{Sales}\times\frac{Sales}{BV\ of\ capital} = After-tax\ Operating\ Margin \times Capital\ Turnover\ Ratio \\ Pre-Tax\ ROC = \frac{EBIT(1-t)}{BV\ of\ Debt+BV\ of\ Equity} = Pre-tax\ Operating\ Margin \times Capital\ Turnover\ Ratio \]

- a high ROC by either increasing its profit margin or more efficiently utilizing its capital to increase sales.

2. Return on Equity

- ROE : profitability from the perspective of the equity investor by relating profits to the equity investor (net profit after taxes and interest expenses) to the book value of the equity investment.

\[ ROE = \frac{Net\ Income}{BV\ of\ Common\ Equity} \]

Net income should be estimated after preferred dividends

Determinants of ROE

\[ ROE = ROC + \frac{BV\ of\ Debt}{BV\ of\ Equity}(ROC-\frac{Interest\ exp\ on\ Debt}{BV\ of\ Debt}(1-tax\ rate))=ROC + benefit\ of\ financial\ leverage\]

→ derivation : \(ROC + \frac{D}{E}(ROC-i(1-t))=\frac{NI+IE(1-t)}{D+E}+\frac{D}{E}(\frac{NI+IE(1-t)}{D+E}-\frac{IE(1-t)}{D})=\frac{NI+IE(1-t)}{D+E}(1+\frac{D}{E})-\frac{IE(1-t)}{E}=\frac{NI}{E}+\frac{IE(1-t)}{E}-\frac{IE(1-t)}{E}=\frac{NI}{E}=ROE \)

Measuring Risk

- Accounting statements do not really claim to measure or quantify risk in a systematic way, other than to provide footnotes and disclosures where there might be risk embedded in the firm

Accounting Principles Underlying Risk Measurement

- risk of default : fixed obligation (interest) will not be met. The broader equity notion of risk, which measures the variance of actual returns around expected returns, does not seem to receive much attention → an all-equity-financed firm with positive earnings and few or no fixed obligations will generally emerge as a low-risk firm from an accounting standpoin

- static view of risk : capacity of a firm at a point in time to meet its obligations

Accounting Measures of Risk

- disclosures about potential obligations or losses in values that show up as footnotes on balance sheets

- the ratios that are designed to measure both liquidity and default risk.

Financial Ratios - Profitability, risk & leverage

- Short-Term Liquidity Risk

\[ current\ ratio=\frac{current\ assets}{current\ liablities}\]

- A current ratio below one, for instance, would indicate that the firm has more obligations coming due in the next year than assets it can expect to turn to cash.

- a trade-off here between minimizing liquidity risk and tying up more and more cash in net working capital

- very high current ratio is indicative of an unhealthy firm, which is having problems reducing its inventory

\[ quick\ ratio=\frac{cash+marketable\ securities}{current\ liabilities}\]

\[Account\ receivable\ turnover = \frac{sales}{average\ accounts\ receivable} \\ inventory\ turnover = \frac{cost\ of\ goods\ sold}{average\ inventory} \\ accounts\ payable\ turnover=\frac{purchases}{average\ accounts\ payable}\]

- the efficiency of working capital management by looking at the relationship of accounts receivable and inventory to sales and to the cost of goods sold.

- measuring the speed with which the firm turns accounts receivable into cash or inventory into sales

\[required\ financing\ period=days\ of\ outstanding + days\ inventory\ held+days\ payable\ outstanding \]

- The greater the financing period for a firm, the greater is its short-term liquidity risk

- Long-term Solvency & default risk

a) Coverage Ratio

- to measure long term solvency try to relate profitability to the level of debt payments

\[ Interest\ Coverage\ Ratio = \frac{EBIT}{Interest\ expense} \]

- higher coverage ratio → more secure for company to make interest payment

- EBIT can drop significantly if the economy enters a recession

\[ Fixed\ Charges\ Coverage\ Ratio=\frac{EBIT+Fixed\ Charges}{Fixed\ Charges} \\ Cash\ Fixed\ Charges\ Coverage\ Ratio=\frac{EBITDA}{Cash\ Fixed\ Charges}\]

- those ratios do not consider capital expenditure, a cashflow that discretionary in the very short term, but not in the long tern if the firm wants to maintain growth

\[Operating\ Cash\ flow\ to\ Capital\ Expenditure = \frac{cash\ flows\ from\ operation}{capital\ expenditure} \\ cash\ flow\ from\ operation = EBIT(1-tax\ rate)-\triangle Working\ capital \]

b) Debt Ratio

- to examine whether it can pay back the principal on outstanding debt

\[ Debt\ to\ Capital\ Ratio = \frac{debt}{debt + equity} \\ Debt\ to\ equity\ ratio=\frac{debt}{equity} \\ Debt/equity\ ratio = \frac{debt/capital\ ratio}{1-debt/capital\ ratio}\]

- it is better to keep it separate and to compute the ratio of preferred stock to capital

c) variants on debt ratio

rationale that short-term debt is transitory and will not affect the long-term solvency

\[long-term\ debt\ to\ capital\ ratio=\frac{long\ term\ debt}{long\ term\ debt + equity} \\ long-term\ debt\ to \ equity\ ratio=\frac{long-term\ debt}{equity}\]

the willingness of many firms to use short-term financing to fund long-term projects → can be a misleading picture of the firm's financial leverage risk

\[market\ value\ debt\ to\ capital\ ratio=\frac{MV\ of\ debt}{MV\ of\ debt+MV\ of\ equity} \\market\ value\ debt\ to\ equity\ ratio=\frac{MV\ of\ debt}{MV\ of\ equity}\]

→ market value의 pros & cons 존재